Data shows a huge variation in success rates in challenging decisions across HMRC departments, writes Andrew Park

Decisions taken against taxpayers by HMRC vary considerably from things like closure notices, tax and penalty determinations and information notices issued by the HMRC investigative departments forming part of HMRC’s Customer Compliance Group (CCG) though to minor automatic late payment and late filing penalties issued by HMRC’s Customer Service Group (CSG).

Regardless of type, most decisions are appealable in the first instance to HMRC’s Independent Reviewer, but there has previously been limited information about the comparative success rates taxpayers have enjoyed.

A myth has developed in some quarters that it is near pointless making an appeal to the Independent Reviewer because they almost never overturn or vary decisions made by HMRC officers. This is not and was never true, but successful appeals on more technical matters have always depended upon having something new to introduce for the Reviewer’s consideration – be that new relevant facts or further legal arguments. Anything that has already involved advice from HMRC’s technical specialists will inevitably involve the Reviewer reading and following that same advice without something new thrown into the mix. Inevitably, that’s often harder than showing that an automatic penalty was invalidly issued.

Now, for the first time, data we have obtained at the Contentious Tax Group (CTG) shows a comprehensive breakdown of success against HMRC’s various departments over the four years to 2023/24.

Dramatically varying degrees of success against HMRC’s investigative departments

HMRC’s investigators are organised into five departments within HMRC Customer Compliance Group (CCG) and comprise:

- Counter-Avoidance – dealing with investigating failed marketed tax avoidance schemes.

- Fraud Investigation Service (FIS) – conducting fraud investigations as well as complex non-fraud related investigations with large amounts of tax at stake (the data here only relates to FIS’s civil investigations).

- Individuals and Small Business Compliance.

- Large Business.

- Wealthy and Midsized Compliance.

Additionally, during the three years to 2023/24, CCG also included the now-disbanded Covid Taxpayer Protection Taskforce, with its figures showing as ‘Compliance Operations Directorate’.

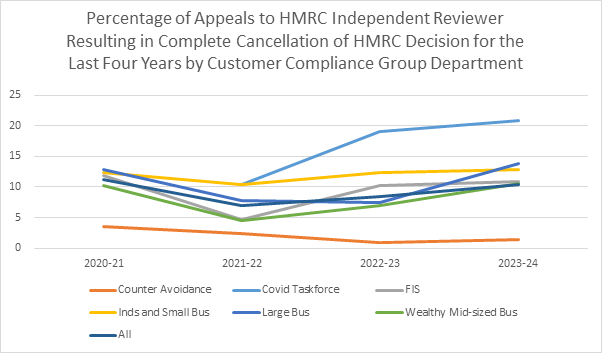

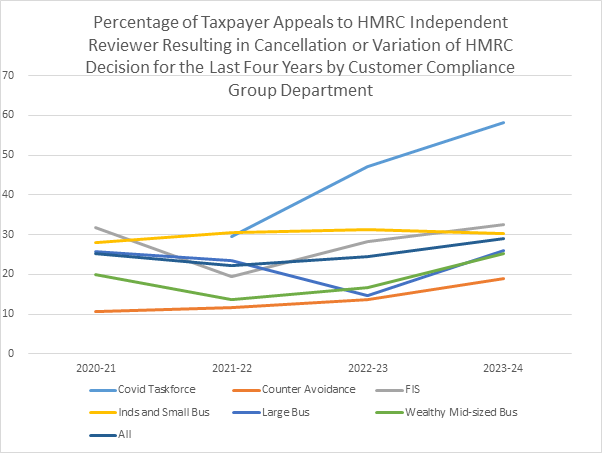

In generality, over 70% of decisions by HMRC’s CCG departments were upheld by the Independent Reviewer in full across all four years. However, there was a marginal overall increase during the period in taxpayers’ success in getting decisions varied.

Taxpayers have enjoyed least success in appealing decisions made by HMRC Counter-Avoidance. Only a tiny and diminishing proportion of appeals against Counter-Avoidance decisions were successful in cancelling often very substantial assessments – down to 1% by 2022/23 and 2023/24 from only 4% in 2020/21. That’s surely not surprising, given HMRC’s success in targeting and shutting down marketed schemes that it has challenged in the courts and the inflexible and consistent way in which taxpayer settlements are dictated as a matter of official policy.

A bit more surprising, though, is the increasing – now 18% – proportion of Counter-Avoidance decisions now varied. That suggests that although Counter-Avoidance have clarity on which schemes don’t work, in an increasing number of cases they’re not getting the detail and the consistency of the liabilities right.

Meanwhile, the number of Fraud Investigation Service tax assessments and penalty determinations successfully challenged is at a four-year high – 22% were varied by the Independent Reviewer in 2023/24 and 11% were cancelled altogether. A greater proportion of FIS decisions were cancelled or varied than decisions made in generally less serious cases by their counterparts dealing with individuals or businesses of all size – perhaps reflecting the greater complexity and subjectivity of many FIS cases.

Notwithstanding the disappointing success rate of taxpayers challenging HMRC Covid support-related decisions in the tax courts – where the courts have applied the Covid legislation rigidly and often with conspicuously unfair outcomes – the taxpayer has been far more successful in preventing appeals reaching that stage by successfully appealing to the Independent Reviewer. Some 58% of Covid Taskforce appeals were at least partly successful in 2023/24 – of which 21% of assessments and determinations were cancelled altogether. That’s was approximately double the initial success rate in 2021/22, suggesting that the quality of HMRC’s initial decision making has sharply deteriorated or that the Independent Reviewers are giving taxpayers more latitude (perhaps out of expediency to finally ‘clear the decks’ of Covid cases) – or maybe both.

High levels of success against automatic penalties

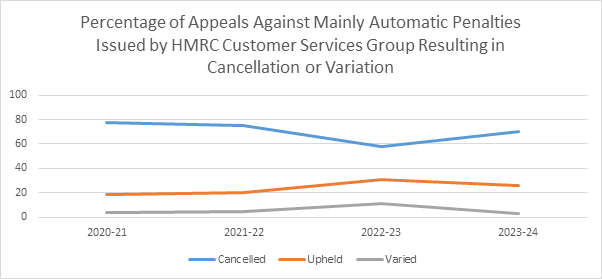

HMRC’s routine automatic penalties – such as late filing penalties – are dealt with by HMRC Customer Service Group.

Unlike appeals against decisions made by HMRC’s investigative departments, taxpayers brought tens of thousands of successful appeals against HMRC CSG for automatic penalties such as the £100 penalty charged to people for being a day late filing their Self-Assessment tax returns. Typically, such appeals are made on grounds of ‘reasonable excuse’ – some exceptional reason beyond the taxpayer’s control for the failure to meet their obligations on time – or because penalties were not validly issued.

Implicitly, HMRC’s Independent Reviewer was broadly accepting of the reasons and arguments offered and granted errant taxpayers significant latitude. Although taxpayer success rates in appealing automatic penalties were at their highest during Covid and peaked at a 78% cancellation rate in 2020/21, that was a reflection of the exceptional excuses Covid provided and a general intent on the part of HMRC and their political masters to grant taxpayers more leeway at a difficult time.

The recent increase in 2023/24 to 70% cancellations from 58% cancellations in 2022/23 appears to reflect the current and ongoing decline in HMRC customer service standards and the ever-greater difficulties experienced by taxpayers in trying get telephone assistance from HMRC to help them meet their obligations. Growing deficiencies in HMRC service standards appear to have led to HMRC having to cancel more of its own penalties but not before putting the taxpayers involved to considerable further nuisance.

The future?

High levels of HMRC staff turnover and the replacement of experienced, competent people with large numbers of new recruits let loose on the public with minimal training does not bode well for the general quality of HMRC decision making.

At the same time, and apparently with that concern in mind, HMRC seems to be trying to ‘dumb down’ many aspects of the compliance system in order to make it more operable by less capable staff – for instance, the pro-forma penalty questionnaires now routinely issued at the conclusion of investigations in place of a more rounded dialogue and nuanced consideration of the circumstances. But such ‘tick-box’ attempts to simplify the process do not simplify the law itself and seem set only to increase the number of poor decisions.

Recent HMRC consultations suggest that the tax authority would dearly like to trade taxpayer protections in various areas for greater efficiency and more limited scope to appeal, but this must be fiercely resisted. Indeed, if anything, hasty legislation may lead to further areas of appeal being required – for instance, the new shift to late payment interest being charged at overtly punitive rates of interest surely means that the application of any such punishment must be subject an appeals process or HMRC will face a raft of human rights litigation.

On the bright side, the 2023/24 lifting of the threshold for the automatic requirement for individual taxpayers to file Self-Assessment returns from £100,000 to £150,000 should greatly reduce the number of people falling foul of late filing penalties where they never had any more tax to declare anyway.

HMRC’s routine automatic penalties – such as late filing penalties – are dealt with by HMRC Customer Service Group.

Unlike appeals against decisions made by HMRC’s investigative departments, taxpayers brought tens of thousands of successful appeals against HMRC CSG for automatic penalties such as the £100 penalty charged to people for being a day late filing their Self-Assessment tax returns. Typically, such appeals are made on grounds of ‘reasonable excuse’ – some exceptional reason beyond the taxpayer’s control for the failure to meet their obligations on time – or because penalties were not validly issued.

Implicitly, HMRC’s Independent Reviewer was broadly accepting of the reasons and arguments offered and granted errant taxpayers significant latitude. Although taxpayer success rates in appealing automatic penalties were at their highest during Covid and peaked at a 78% cancellation rate in 2020/21, that was a reflection of the exceptional excuses Covid provided and a general intent on the part of HMRC and their political masters to grant taxpayers more leeway at a difficult time.

The recent increase in 2023/24 to 70% cancellations from 58% cancellations in 2022/23 appears to reflect the current and ongoing decline in HMRC customer service standards and the ever-greater difficulties experienced by taxpayers in trying get telephone assistance from HMRC to help them meet their obligations. Growing deficiencies in HMRC service standards appear to have led to HMRC having to cancel more of its own penalties but not before putting the taxpayers involved to considerable further nuisance.

The future?

High levels of HMRC staff turnover and the replacement of experienced, competent people with large numbers of new recruits let loose on the public with minimal training does not bode well for the general quality of HMRC decision making.

At the same time, and apparently with that concern in mind, HMRC seems to be trying to ‘dumb down’ many aspects of the compliance system in order to make it more operable by less capable staff – for instance, the pro-forma penalty questionnaires now routinely issued at the conclusion of investigations in place of a more rounded dialogue and nuanced consideration of the circumstances. But such ‘tick-box’ attempts to simplify the process do not simplify the law itself and seem set only to increase the number of poor decisions.

Recent HMRC consultations suggest that the tax authority would dearly like to trade taxpayer protections in various areas for greater efficiency and more limited scope to appeal, but this must be fiercely resisted. Indeed, if anything, hasty legislation may lead to further areas of appeal being required – for instance, the new shift to late payment interest being charged at overtly punitive rates of interest surely means that the application of any such punishment must be subject an appeals process or HMRC will face a raft of human rights litigation.

On the bright side, the 2023/24 lifting of the threshold for the automatic requirement for individual taxpayers to file Self-Assessment returns from £100,000 to £150,000 should greatly reduce the number of people falling foul of late filing penalties where they never had any more tax to declare anyway.

• Andrew Park is a tax investigations partner at Price Bailey. Email Andrew.Park@pricebailey.co.uk